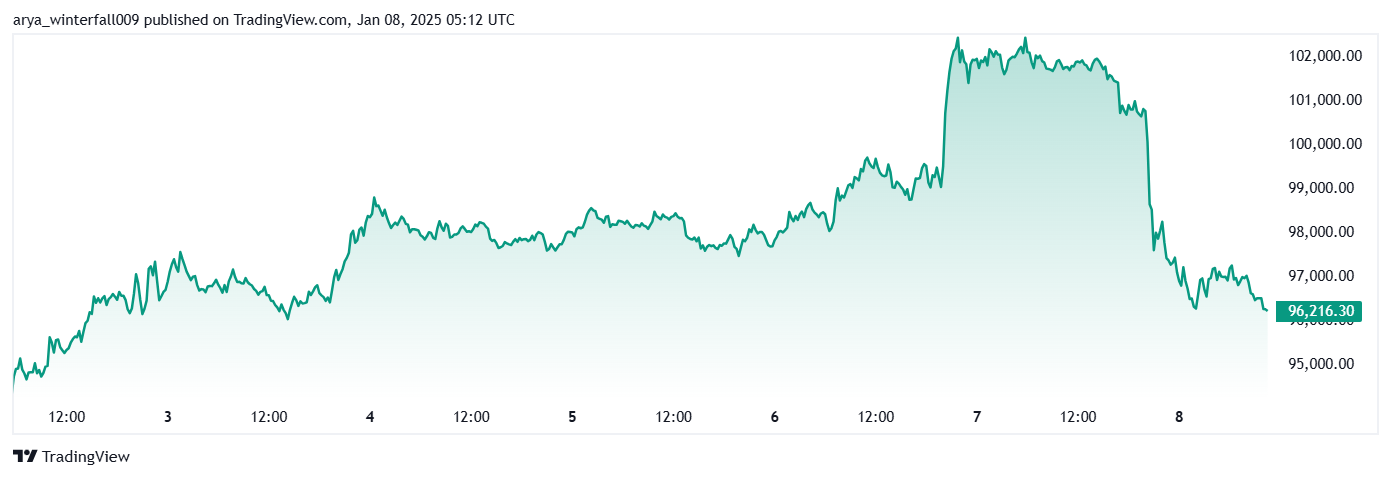

As of January 8, 2025, Bitcoin (BTC) is trading at approximately $101,000, maintaining a strong position as it seeks to reclaim its all-time high of $108,135 reached in December 2024. This current price reflects a notable recovery from recent fluctuations and highlights the ongoing resilience of the leading cryptocurrency.

Recent Market Activity

Bitcoin’s price has shown significant movement over the past week, with fluctuations that have kept traders on their toes. After dipping below $100,000, BTC has rebounded strongly, demonstrating robust support at this psychological level. The cryptocurrency market sentiment remains cautiously optimistic, with many analysts predicting that Bitcoin could soon break through its previous highs if current trends continue.

Factors Influencing Bitcoin’s Price

- Institutional Interest: Increased interest from institutional investors continues to drive demand for Bitcoin. As more financial institutions adopt cryptocurrency strategies, the influx of capital is likely to support higher price levels.

- Market Sentiment: The overall sentiment in the cryptocurrency market is currently bullish, with the Fear & Greed Index indicating a score of 66, suggesting that investors are leaning towards greed. Positive sentiment often correlates with upward price movements.

- Technical Indicators: Analysts are observing key technical indicators that suggest a potential breakout. If Bitcoin can maintain its position above $100,000 and break through resistance levels around $102,500, it may pave the way for a rally towards its all-time high.

Future Price Predictions

Market experts are divided on Bitcoin’s immediate future. Some predict that if the upward momentum continues, BTC could reach between $105,000 and $110,000 by the end of January 2025. However, caution is advised as volatility remains a hallmark of the cryptocurrency market.

Conclusion

With Bitcoin currently hovering around $101,000, all eyes are on whether it can reclaim its all-time high of $108,135. The combination of strong institutional interest, positive market sentiment, and favorable technical indicators suggests that a breakout could be on the horizon. Investors are encouraged to stay informed and consider market dynamics as they navigate this volatile landscape.