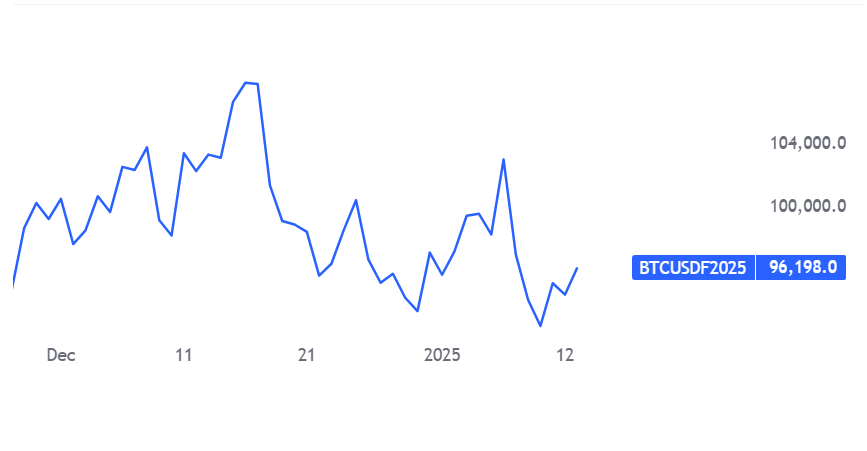

As of January 12, 2025, Bitcoin (BTC) is trading at approximately $95,791.67, but that hasn’t stopped prominent crypto influencer Jeremie Davinci from making a bold prediction: he believes Bitcoin could soar to $350,000 in the near future. This audacious forecast has sparked widespread discussion among investors and analysts as they consider the implications of such a price target.

The Rationale Behind the Prediction

Jeremie Davinci’s prediction is grounded in historical trends and the current dynamics of Bitcoin mining costs. He notes that the cost for miners to produce one Bitcoin is currently around $70,000. Historically, during bullish market conditions, Bitcoin has often traded at a multiple of its mining cost—typically exceeding it by a factor of five. If this trend continues, Davinci argues that a price of $350,000 could be within reach.In his recent social media posts, Davinci stated:

“It costs miners about $70k to produce 1 #Bitcoin now… In past bull markets, Bitcoin’s price has hit over 5x the mining cost. Huge potential ahead!”

This correlation between mining costs and market value provides a compelling framework for his prediction. As mining expenses rise due to increasing energy prices and technological demands, the value of Bitcoin may also need to adjust upward to maintain profitability for miners.

Market Conditions and Influencer Opinions

The cryptocurrency market has shown significant volatility recently, with Bitcoin experiencing fluctuations that have kept traders on edge. Despite this uncertainty, many investors are optimistic about Bitcoin’s long-term potential. The recent surge in institutional interest and favorable regulatory discussions under the new administration have contributed to a bullish sentiment. Alongside Davinci’s prediction, other notable figures in the crypto space have weighed in on the potential for Bitcoin to reach $350,000. Robert Kiyosaki, author of “Rich Dad Poor Dad,” has also expressed similar sentiments, suggesting that Bitcoin could achieve this milestone by 2026. Kiyosaki emphasizes Bitcoin’s role as a hedge against inflation and its growing acceptance as “digital gold. “However, not all experts share this optimistic outlook. Some analysts caution that while significant price increases are possible, projecting such high valuations involves numerous speculative assumptions. Factors such as macroeconomic conditions, regulatory changes, and technological advancements will play crucial roles in determining Bitcoin’s trajectory.

Challenges Ahead

While the prospect of Bitcoin reaching $350,000 is enticing for investors, several challenges may impede this path:

- Regulatory Landscape: The cryptocurrency market is still navigating a complex regulatory environment. Clearer regulations could either facilitate or hinder Bitcoin’s progress. A hostile regulatory climate could dampen investor enthusiasm and slow down adoption.

- Market Volatility: The cryptocurrency market is known for its extreme volatility. Significant fluctuations or unforeseen global events could drastically alter price forecasts and investor sentiment.

- Technological Developments: Innovations in blockchain technology and competing cryptocurrencies may also impact Bitcoin’s dominance and market position.

- Macroeconomic Factors: Global economic conditions, including inflation rates and monetary policy decisions by central banks, will significantly influence investor behavior and asset valuations.

Conclusion

Jeremie Davinci’s bold prediction of Bitcoin reaching $350,000 has ignited discussions within the crypto community as investors weigh the potential for significant gains against the backdrop of existing challenges. While historical trends provide a framework for optimism, it is crucial for investors to remain cautious and informed about the various factors that could influence Bitcoin’s price trajectory. As we move further into 2025, all eyes will be on how these dynamics unfold in an ever-evolving cryptocurrency landscape. Whether or not Bitcoin can achieve such lofty heights remains uncertain; however, its journey will undoubtedly continue to captivate traders and investors alike.